Bank Loans

If you've got a goal, we're here to help you meet it with affordable financing. Our quick loans come with competitive rates, flexible terms and convenient online banking. Reach out or visit a local branch to ask about bank loans today.

Auto Loans

Get a great fixed rate for your new or new-to-you ride.

- Good for new or used vehicles

- Flexible terms available up to 84 months

- Competitive fixed rates and monthly payments

Get Started Get started with an auto loan

Home Equity Lines and Loans

Get the funds you need to start your next project at home.

- Access competitive low interest rates

- Use your home's equity to achieve your goals

Get Started Get started with home equity lines and loans

Home Improvement Loans

Quickly get the funds you need to repair or remodel your home.

- Competitive low interest rates

- Convenient, quick and simple loan process

- Unsecured loan—no home equity required

Get Started Get started with a home improvement loan

Lot Loans

Buy land today, then develop your property or build your dream home tomorrow.

Get Started Get started with lot loans

Money Saver Mortgages

Take advantage of today's rates to decrease your monthly mortgage payment.

- Pay off your home faster with shorter terms

- Competitive low fixed or adjustable interest rates

- Pay lower fees and upfront costs

Get Started Get started with a money saver mortgage

Specialized Lending

We'll help you find an affordable way to achieve your goals.

- Great options for boat loans and RV loans

- Competitive fixed rates and monthly payments

- Other specialized loan options available

Get Started Get started with specialized lending options

Ask us about other loan options we have available

Is it time to consolidate your debt with a bank loan?

Get a personal loan for what you need

You could save on higher-interest balances with our competitive rates on personal loans.

- Competitive rates

- No prepayment penalty

- Fixed or variable rates

- Secured or unsecured

Digital Banking

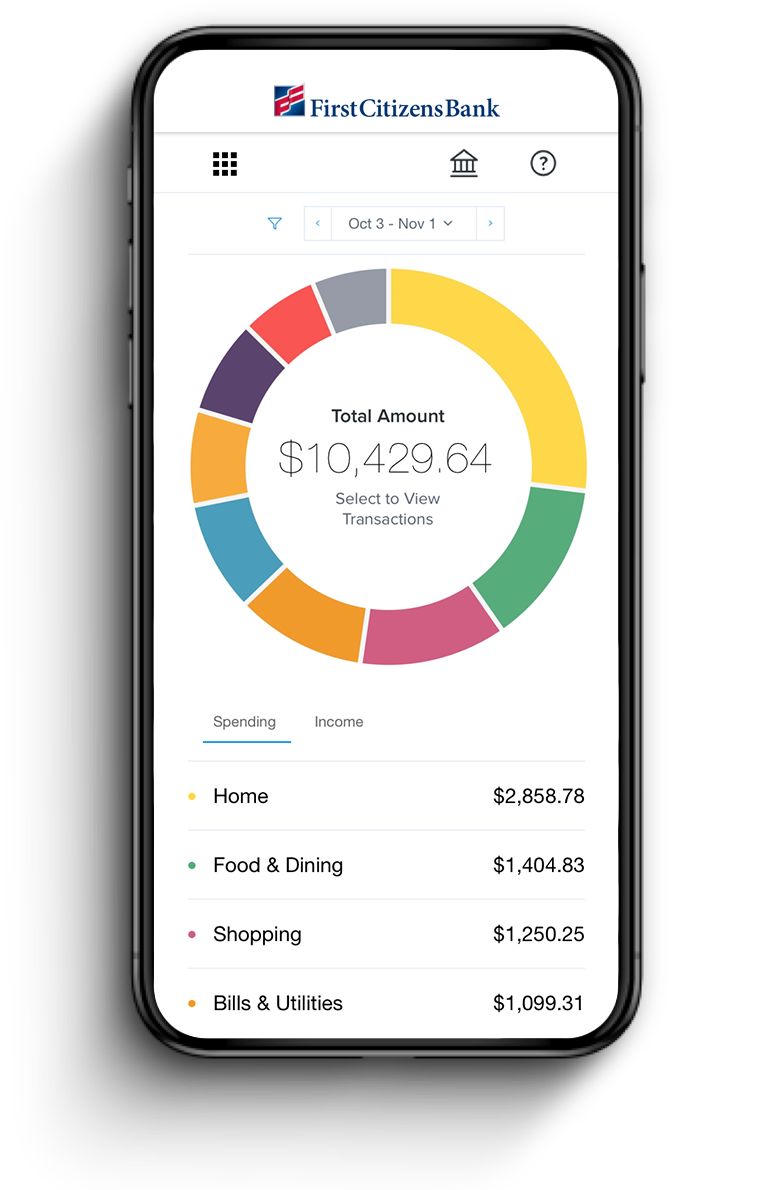

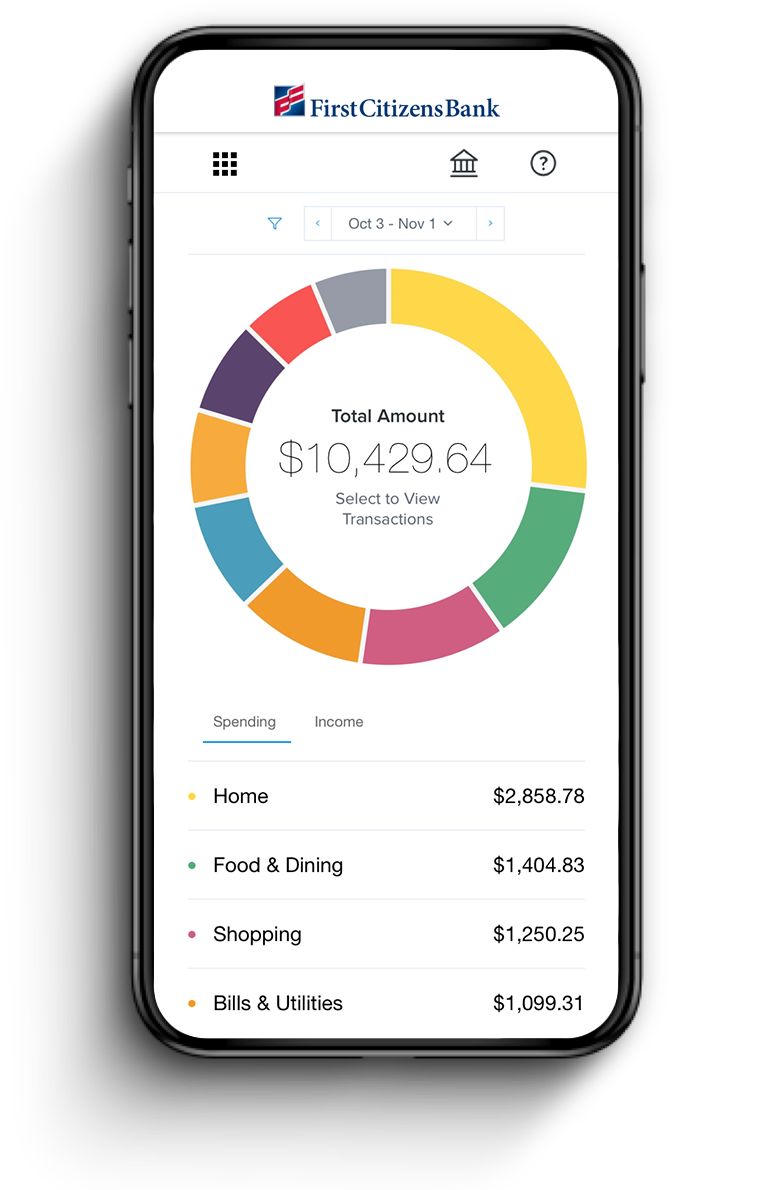

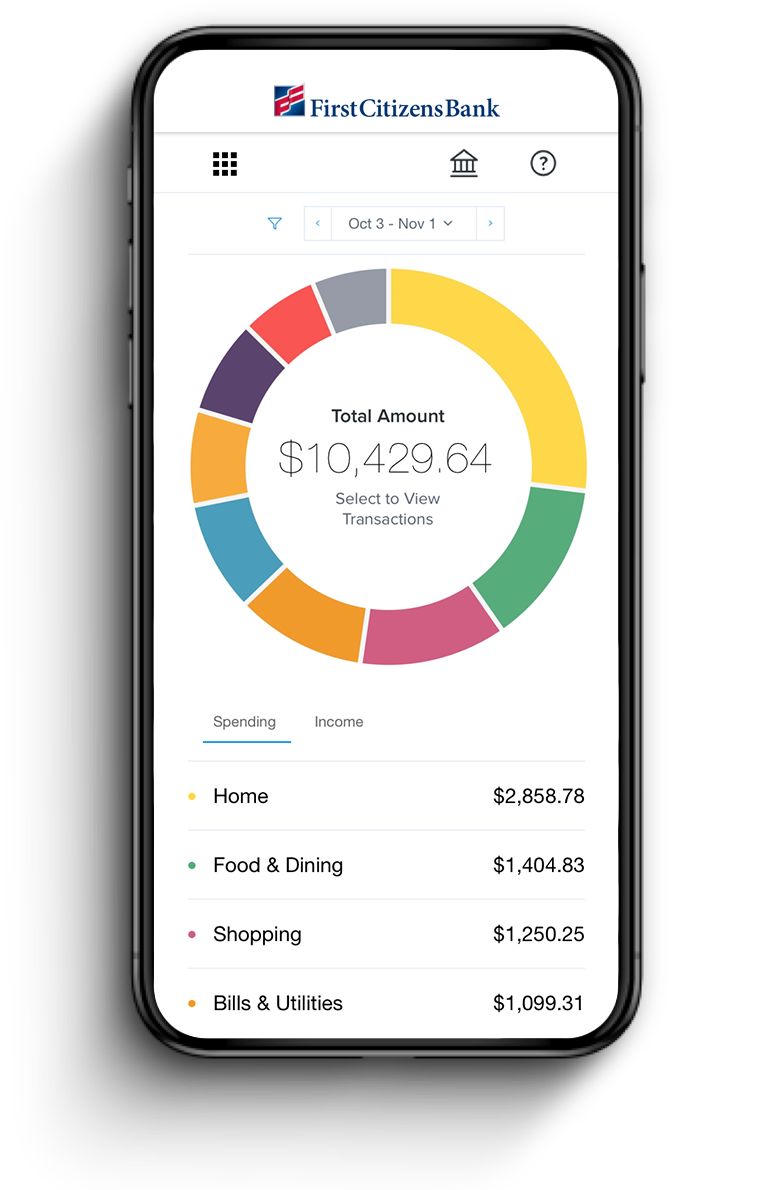

Track your spending habits

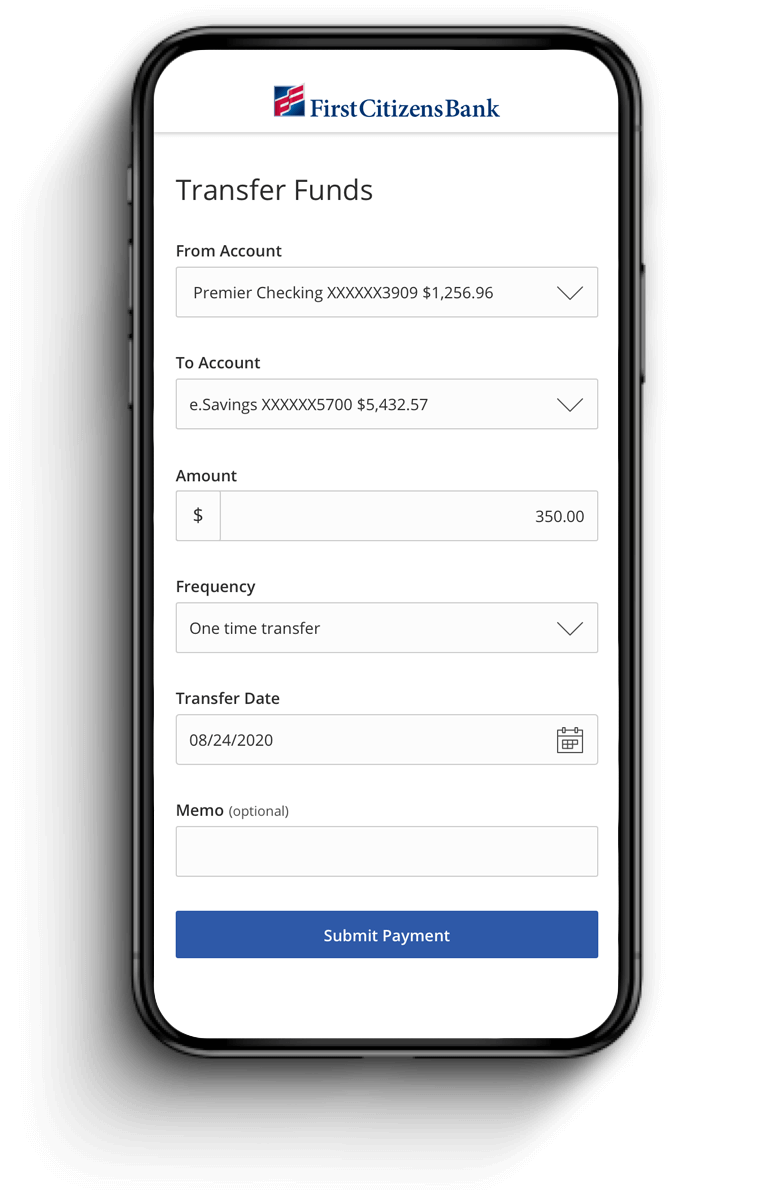

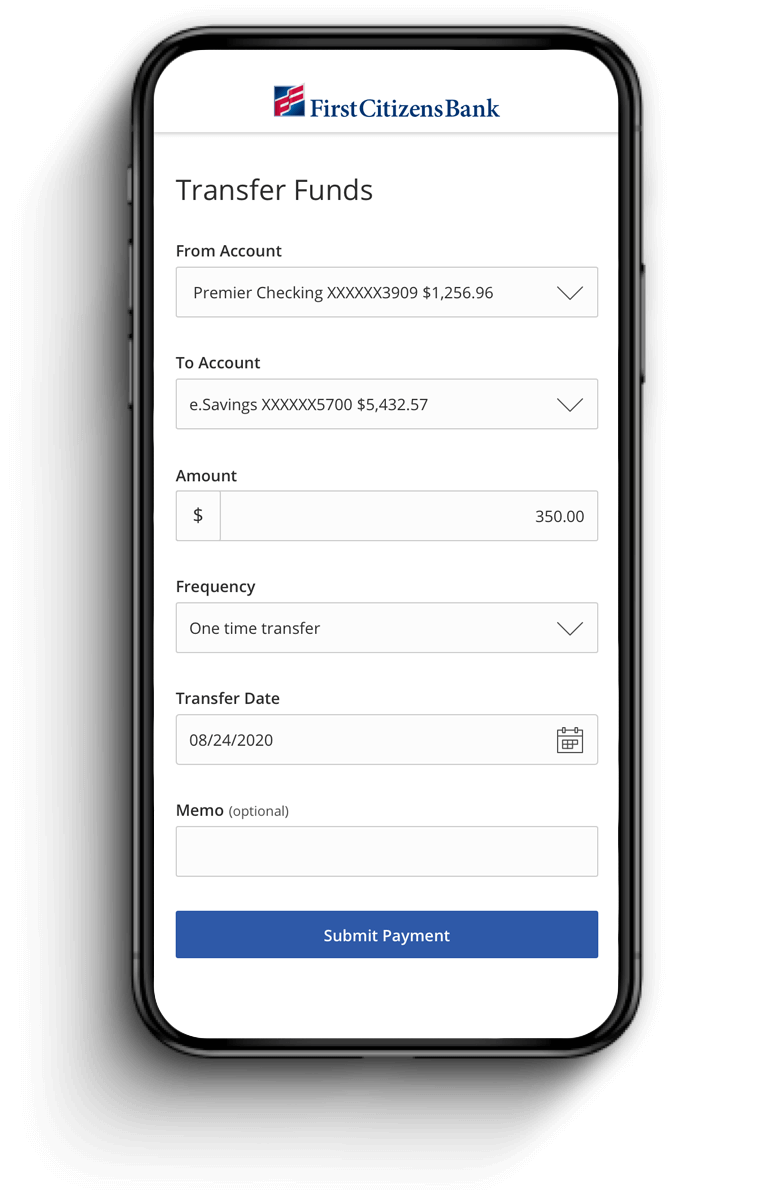

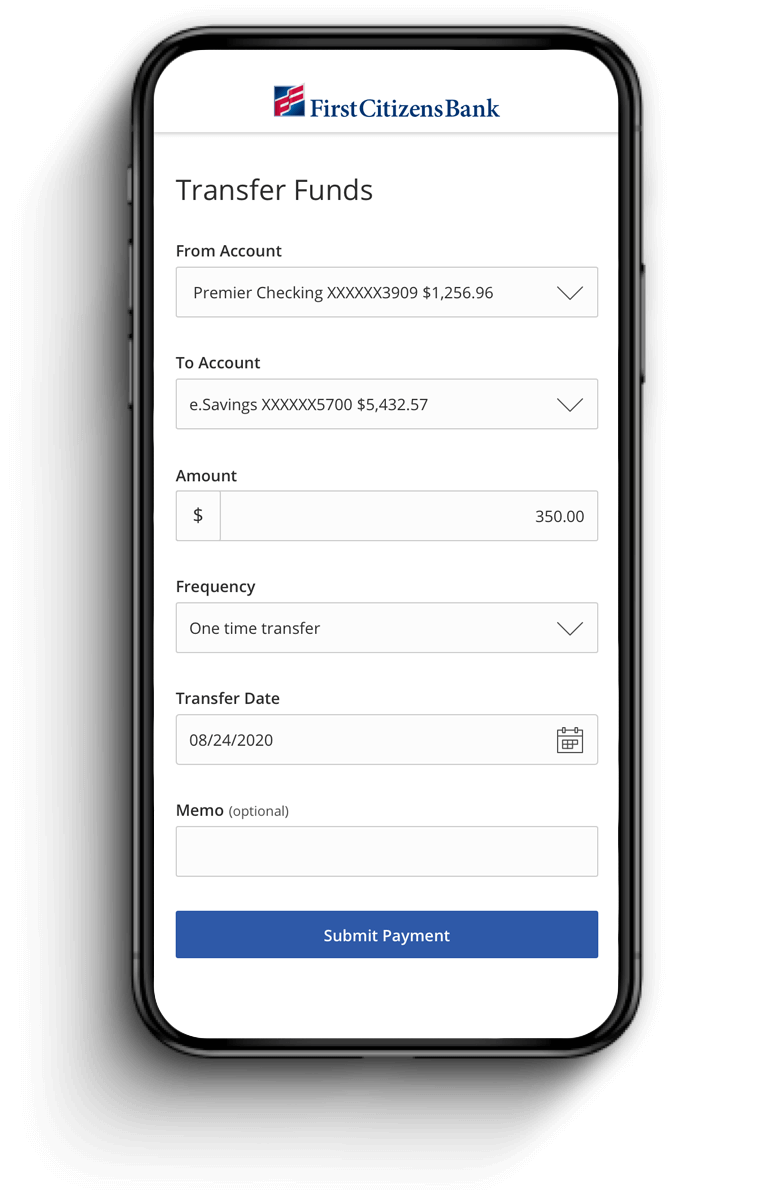

Seamlessly move your money

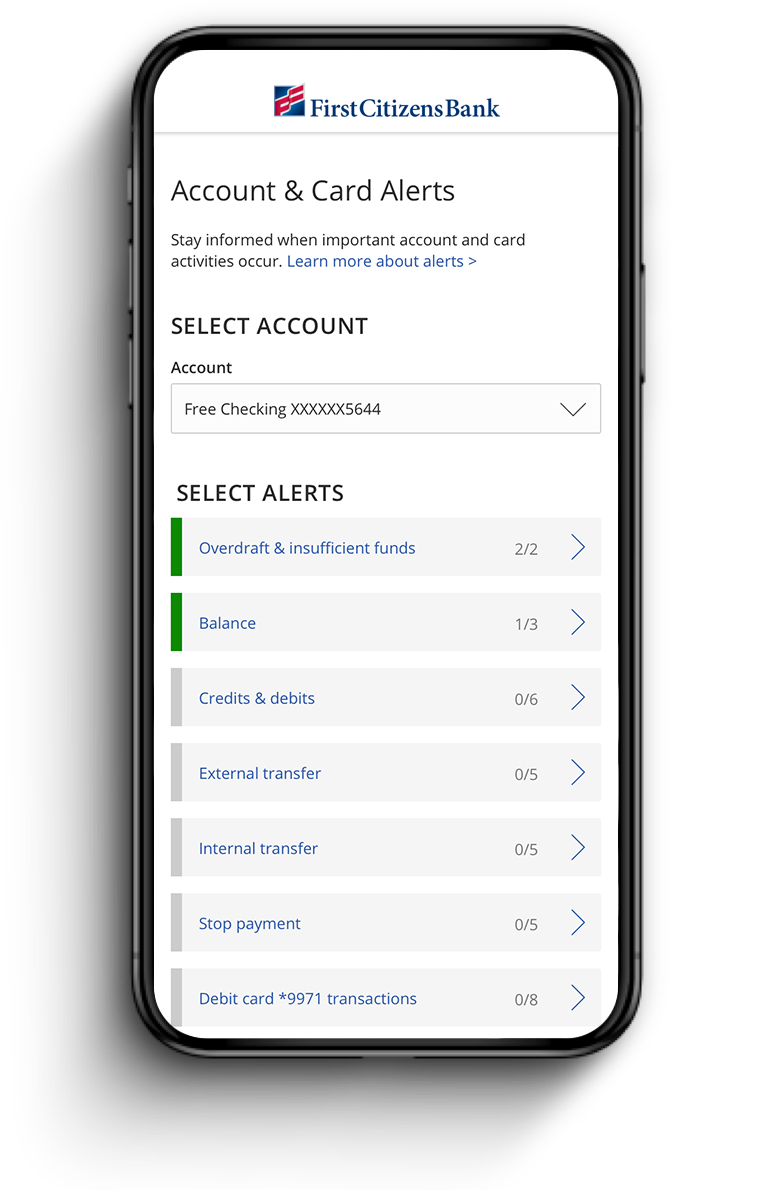

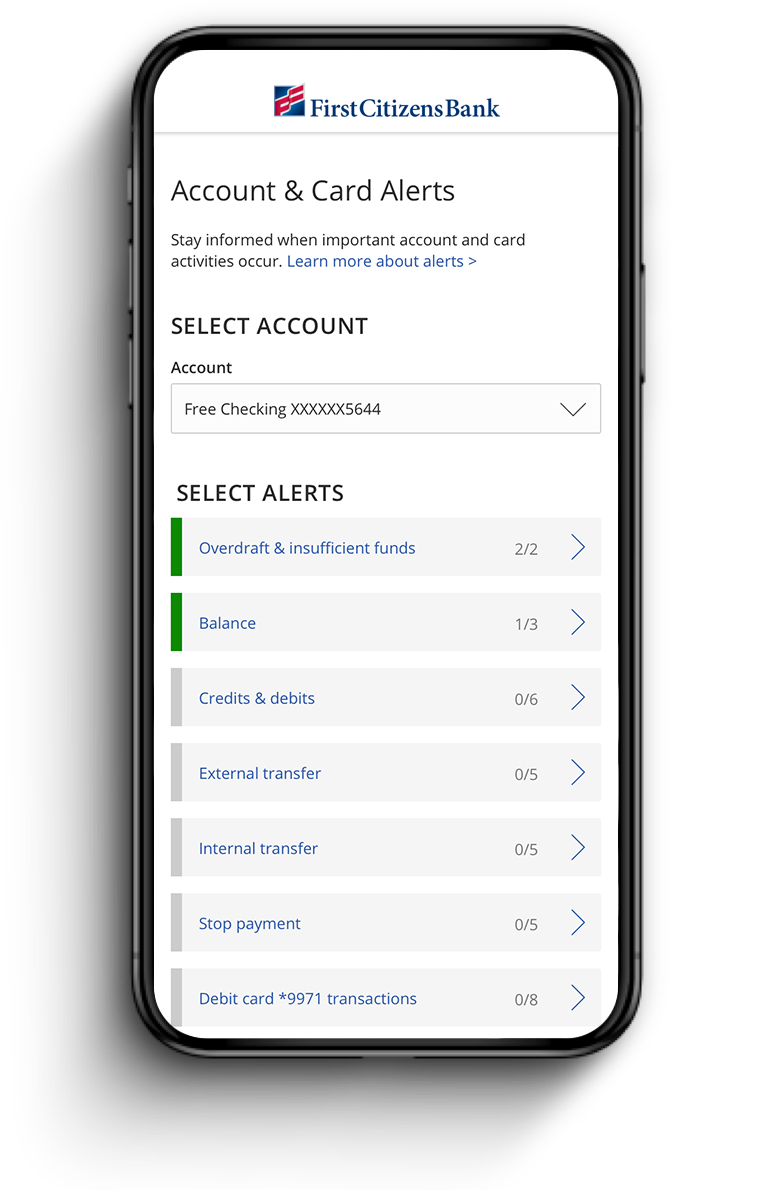

Set alerts for transactions

Digital Banking

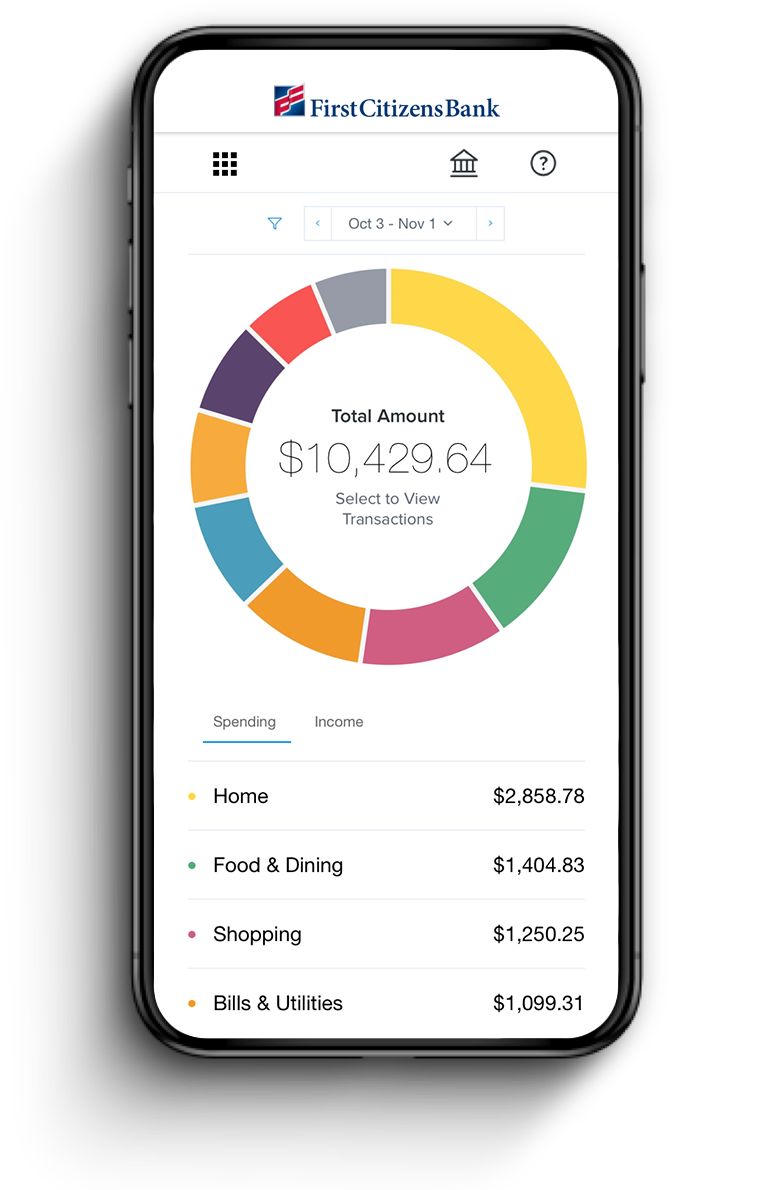

Track your spending habits

Digital Banking

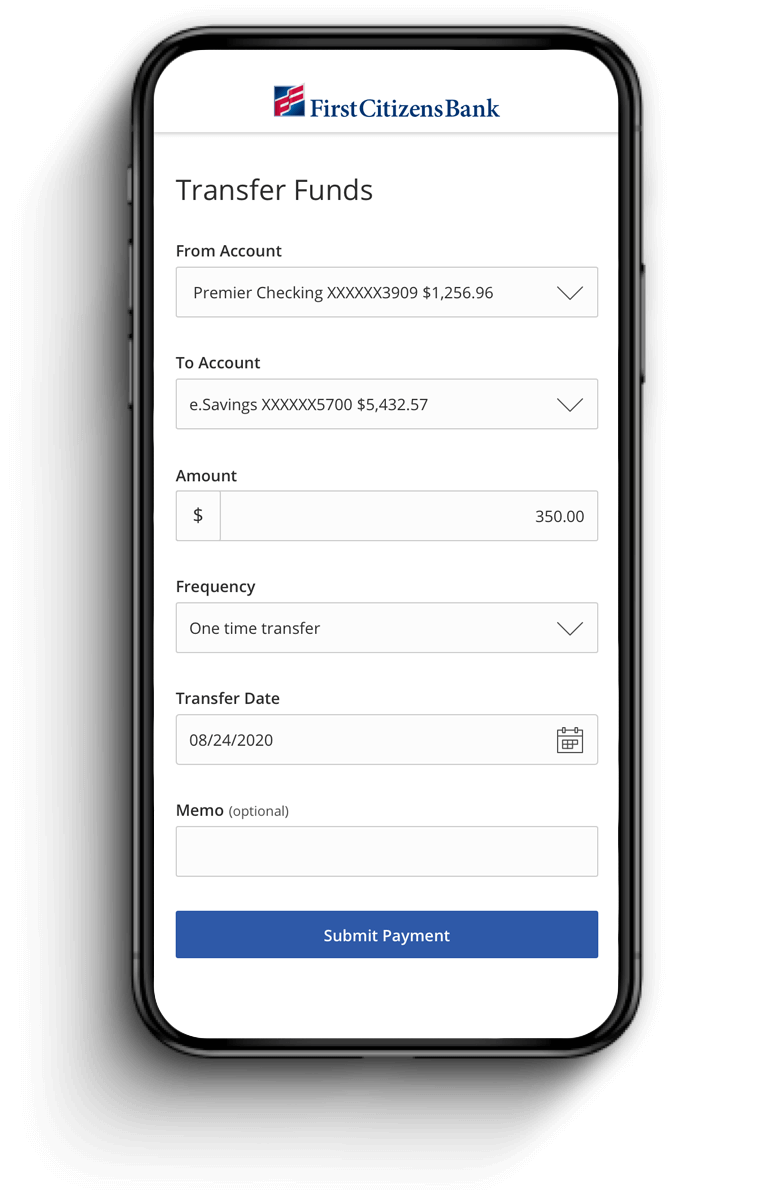

Seamlessly move your money

Digital Banking

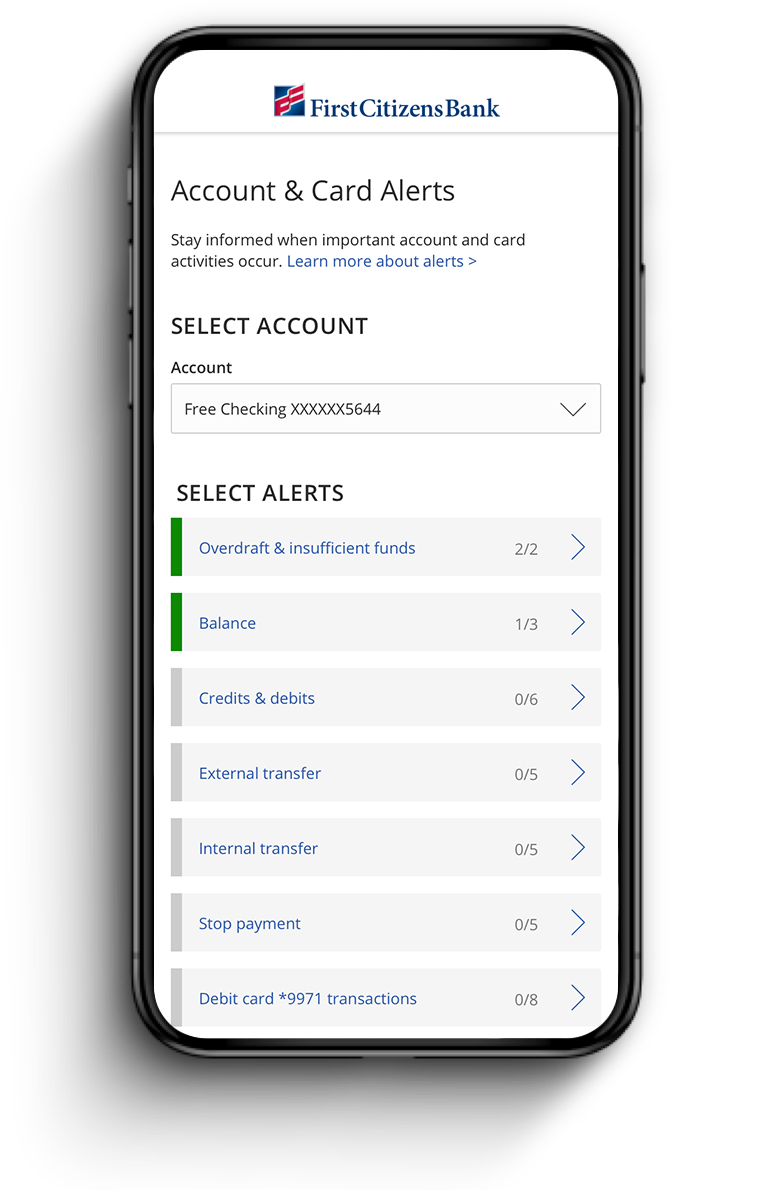

Set alerts for transactions

Cash Rewards

Get cash back on every purchase

Keep it simple. Earn unlimited cash back and pay no annual fee with our Cash Rewards credit card.

Online Savings

Save online, simply and conveniently

Open an online savings account with a low minimum opening deposit of $50.

A few financial insights for your life

A Breakdown of the 5 Cs of Credit

Discover the five factors that guide banks' lending decisions.

Banks typically look for a debt-to-income ratio of less than 36% as an indicator of a responsible borrower.

How Personal Loans Can Help Financial Wellness

Getting a personal loan could help you consolidate your debt or increase your credit score.

Making monthly payments toward a loan tells lenders you're responsible with your debt.

Debt Consolidation: What to Consider as Rates Rise

With interest rates projected to rise even further, is now the right time to consolidate debt?

Debt consolidation with lower interest can help you pay down your debt more quickly.

Disclosures

Account openings and credit are subject to bank approval.

With qualifying EquityLine. The minimum line amount required is $25,000 or more.

With qualifying EquityLine. The line amount required is $100,000 or more.

Consult your tax advisor regarding the deductibility of interest.

Links to third-party websites may have a privacy policy different from First Citizens Bank and may provide less security than this website. First Citizens Bank and its affiliates are not responsible for the products, services and content on any third-party website.

Bank deposit products are offered by First Citizens Bank. Member FDIC and an Equal Housing Lender. icon: sys-ehl.